Bitcoin “Social Dominance” Surges As Altcoins Struggle

Data shows that Bitcoin’s social dominance has surged to high values recently as interest in altcoins among investors has waned recently.

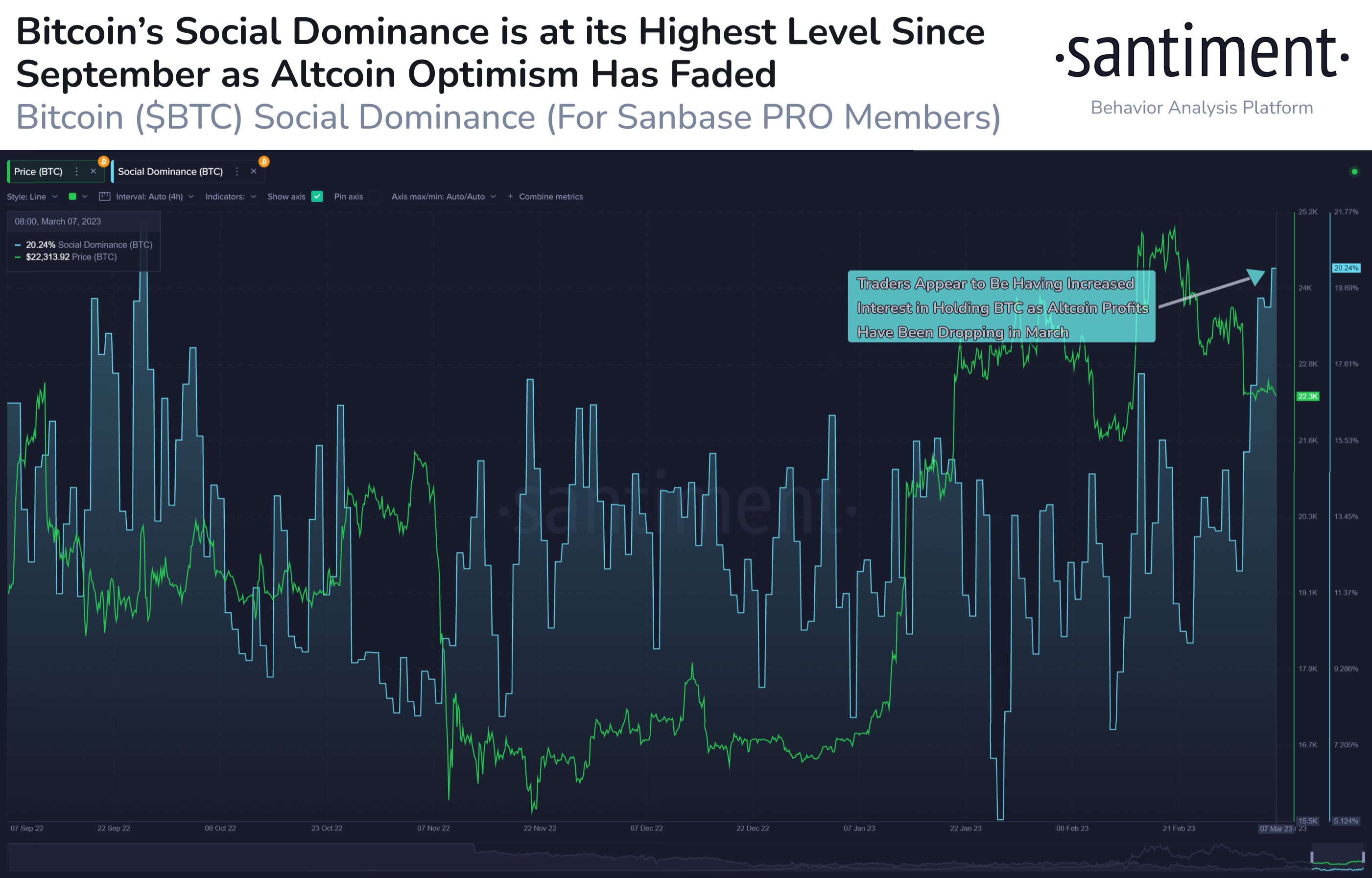

Bitcoin Social Dominance Is Now At Its Highest Level Since September 2022

As per data from the on-chain analytics firm Santiment, attention has returned to BTC recently. “Social dominance” is an indicator that tells us what share of the discussions happening on social media currently involve a specific cryptocurrency (which, in the present case, is Bitcoin).

A relevant metric here is the “social volume,” which measures the total amount of social media text documents that make at least one mention of the given asset. The text documents here include a variety of social media-related pieces, like tweets, forum posts, Reddit threads, telegram chats, etc.

A key feature of the metric is that it counts any text document only once regardless of how many times it may contain the keyword (and obviously, there has to be at least one mention for it to be counted at all). For example, if a long forum post contains “BTC” 10 times, the post still contributes only 1 unit towards the asset’s social volume.

The social dominance works by comparing this social volume of BTC (or any other asset) with the combined social volume of the top 100 coins according to market cap.

Naturally, whenever this indicator has a high value, it means Bitcoin is making up for a high percentage of the total crypto-related discussions that are taking place on the internet. Such a trend suggests that the interest in the original cryptocurrency is high currently.

Now, here is a chart that shows the trend in BTC’s social dominance over the last few months:

As displayed in the above graph, Bitcoin’s social dominance has sharply surged recently as the prices of most altcoins have observed declines. BTC itself has taken a beating in March so far, but its losses have still been smaller than a lot of the other assets in the sector.

The current value of the indicator is the highest it has been since the September of last year. This high social dominance of the cryptocurrency suggests BTC has been taking up a large part of investor attention recently.

The better strength of Bitcoin as compared to the altcoins also means that investors may have been leaving alts during the past couple of weeks and buying into BTC instead.

“Higher Bitcoin social dominance historically has initiated market rebounding,” notes Santiment. If this past pattern follows now as well, then the current strength of BTC may be building towards a sustainable recovery push in the coming days.

BTC Price

At the time of writing, Bitcoin is trading around $22,000, down 7% in the last week.

Comments

Leave a Comment